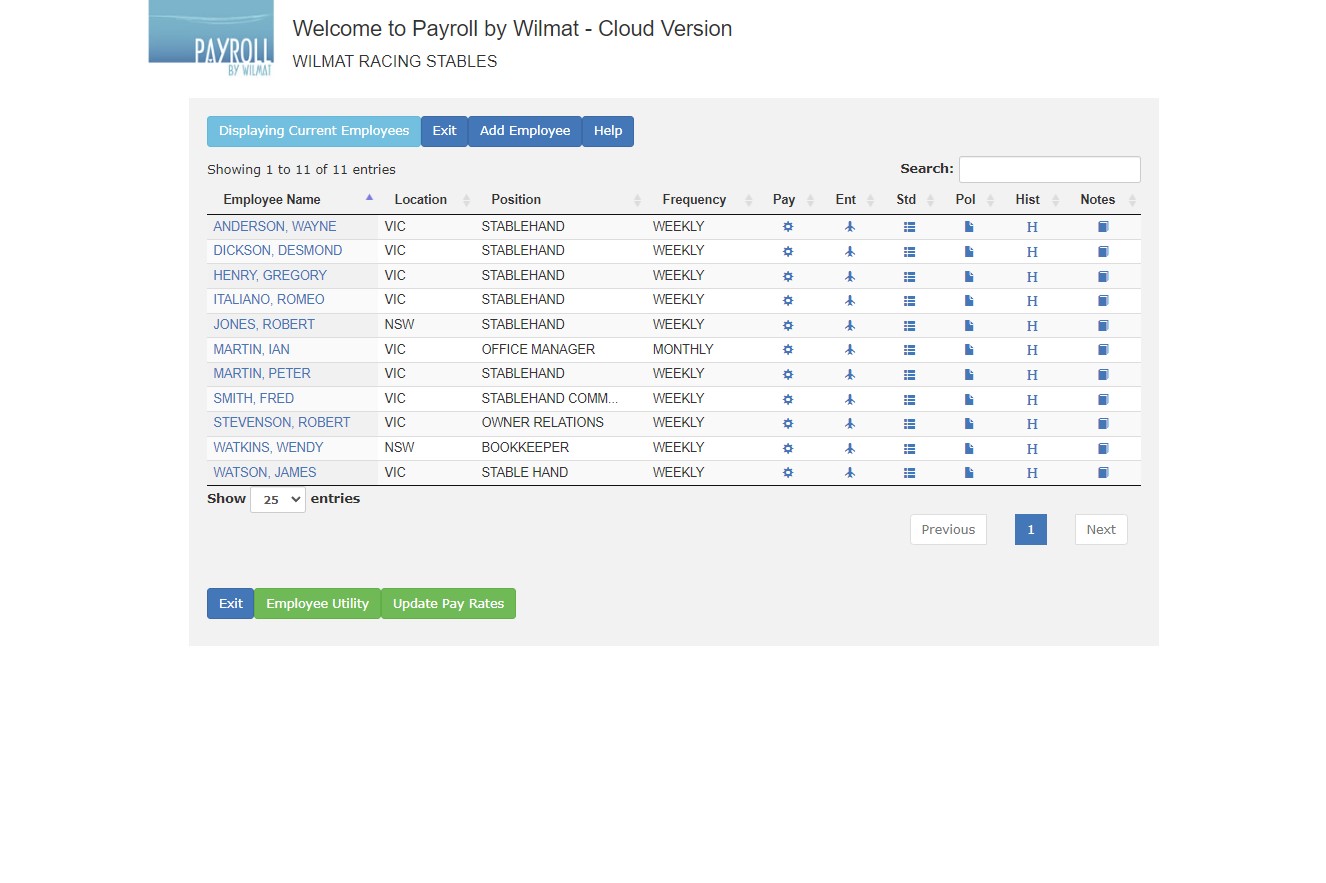

Payroll by Wilmat Tour - Employees

Select Displaying Current Employees to display Terminated Employees. Selecting Display Terminated Employees will display all employees. Selecting Displaying All Employees to return to the display of current employees.

Select Add Employee to add a new employee or click the required employee to make changes to the employee's name and address.

Select the icon in the Pay column to access payroll details for the required employee.

Select the icon in the Ent column to access entitlement details for the required employee.

Select the icon in the Std column to access standard pay entries for the required employee.

Select the icon in the Pol column to access employments policies that apply to the required employee.

Select the icon in the Hist column to access payroll history for the required employee.

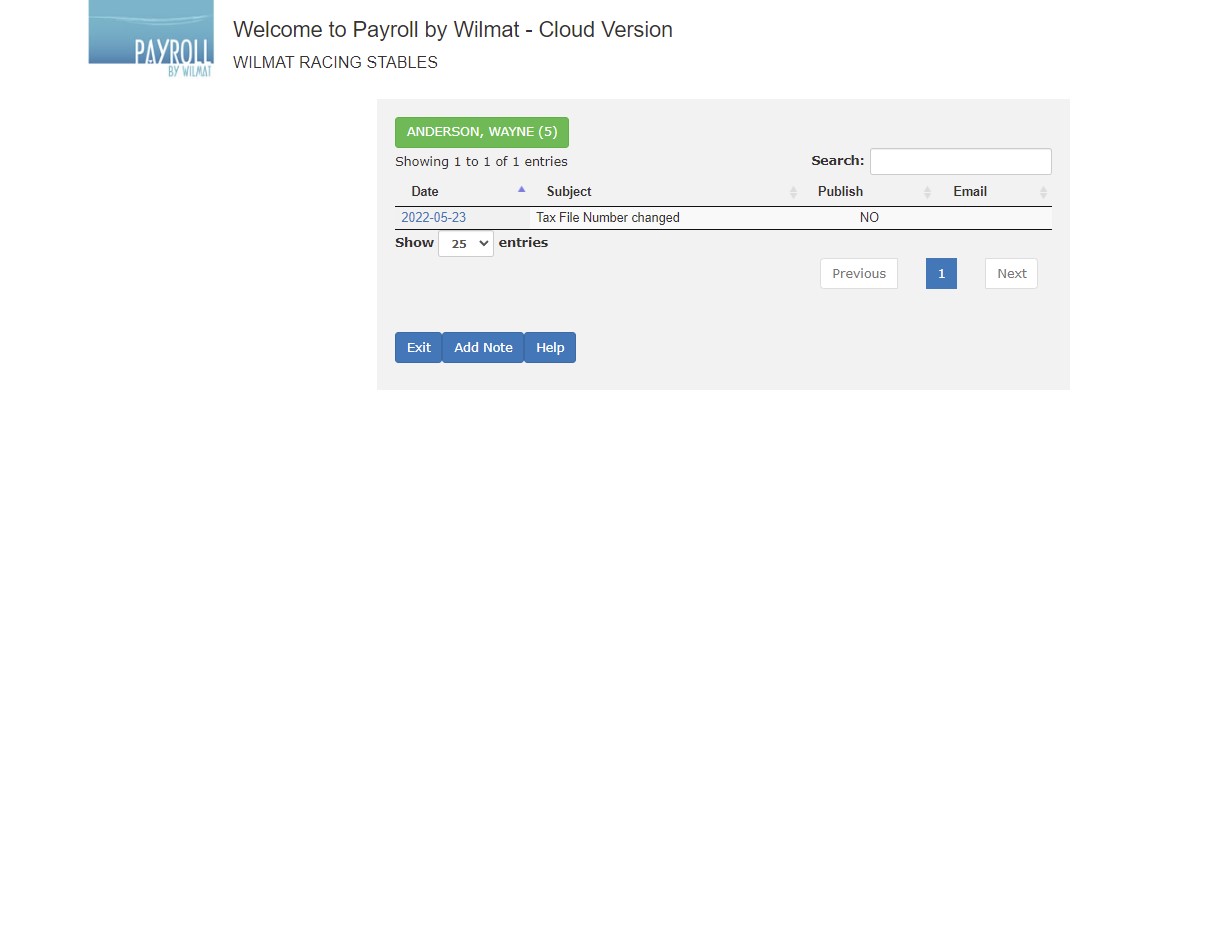

Select the icon in the Notes column to access notes for the required employee.

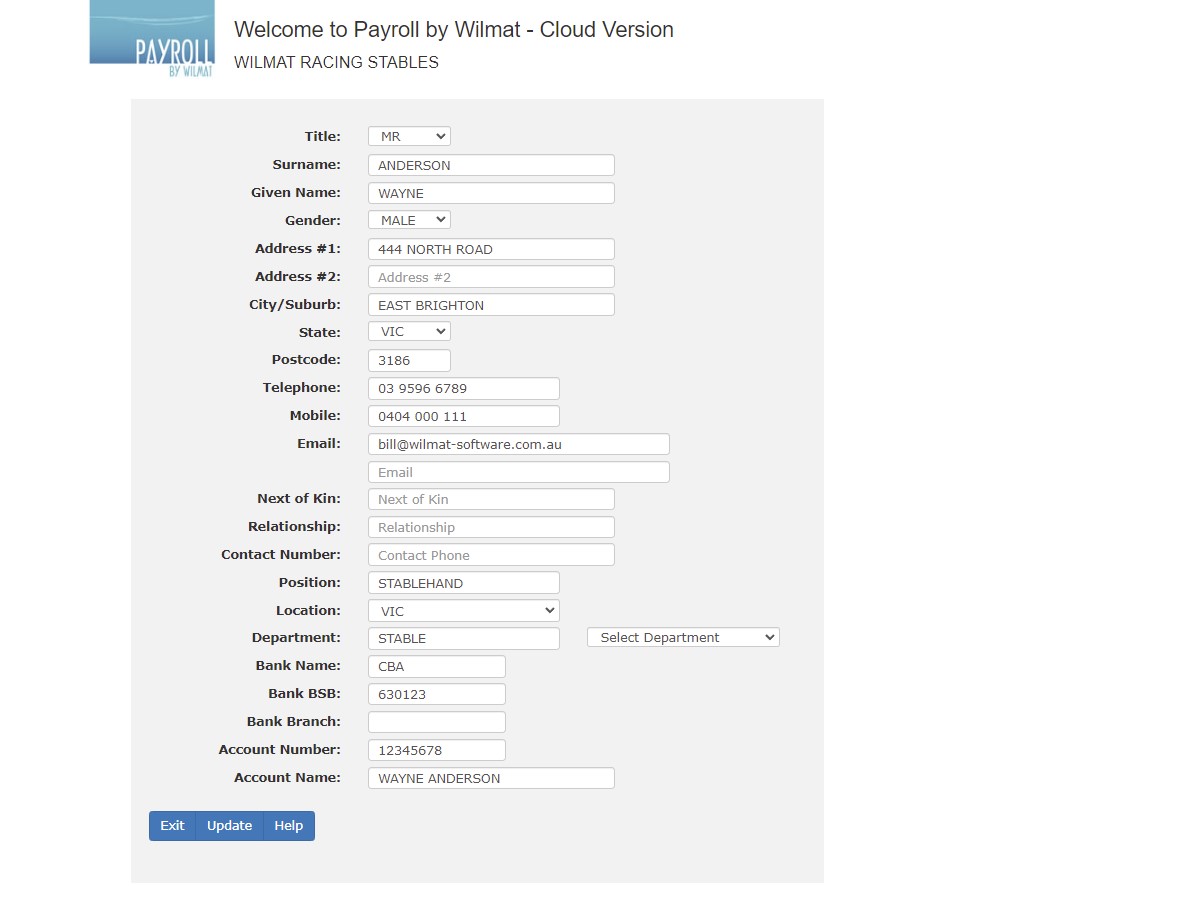

Employee Details

Ensure that the employee's name and address details are fully recorded. This information is included when lodging your Single Touch Payroll data with the ATO.

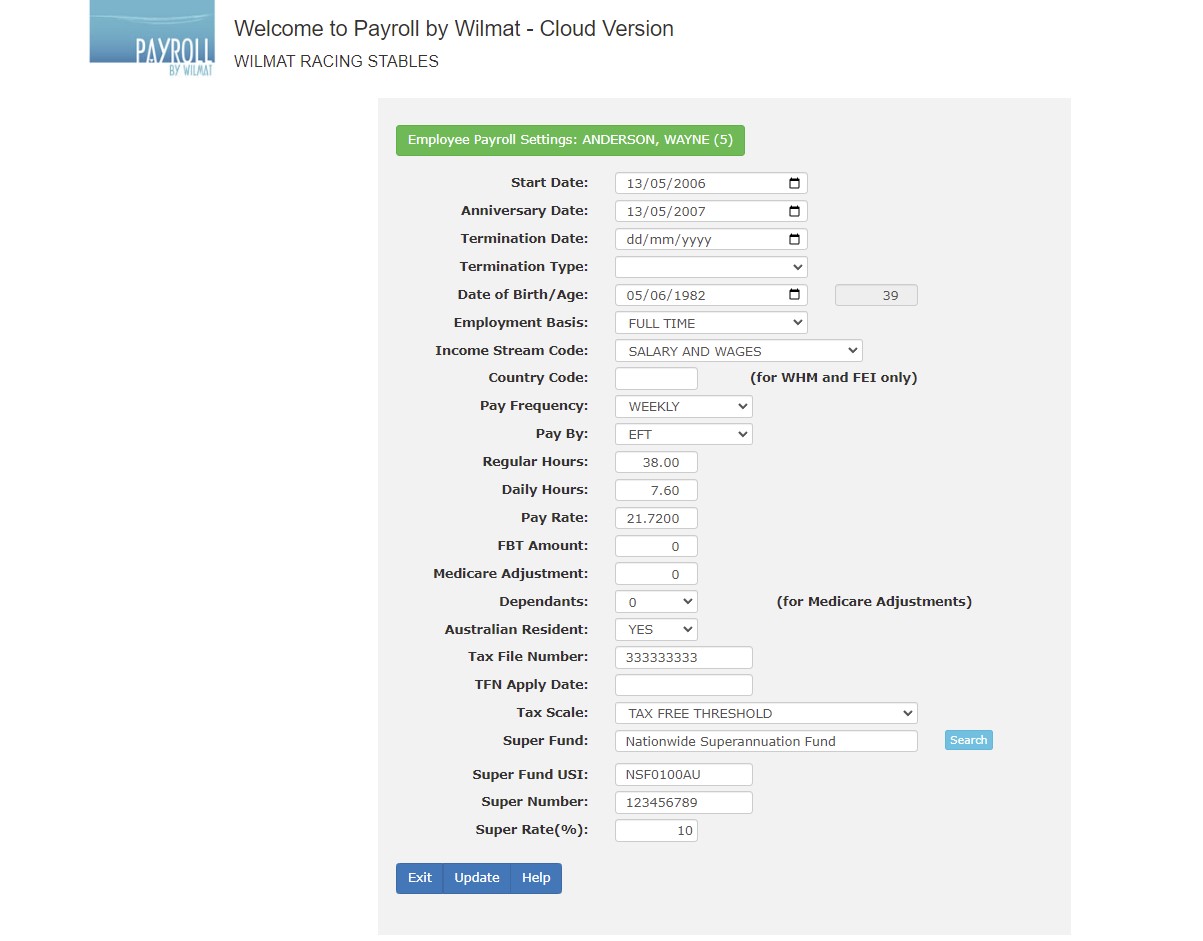

Payroll Details

The employee payroll details are required to ensure that the employee is taxed at the correct rate.

A valid, 2 character lowercase, Country Code is required for Working Holiday Makers and Foreign Employment Income employees. Commonnly used country codes are gb - United Kingdom, fr - France, ie - Ireland, de - Germany, jp - Japan, it - Italy. A full list of Country Codes can be found at ISO 3166 Country Codes

The employee must provide a Tax File Number within 28 days of commencement of employment otherwise the employer is obliged to deduct tax based on the No Tax File Number - Residenets, which is currently 47%.

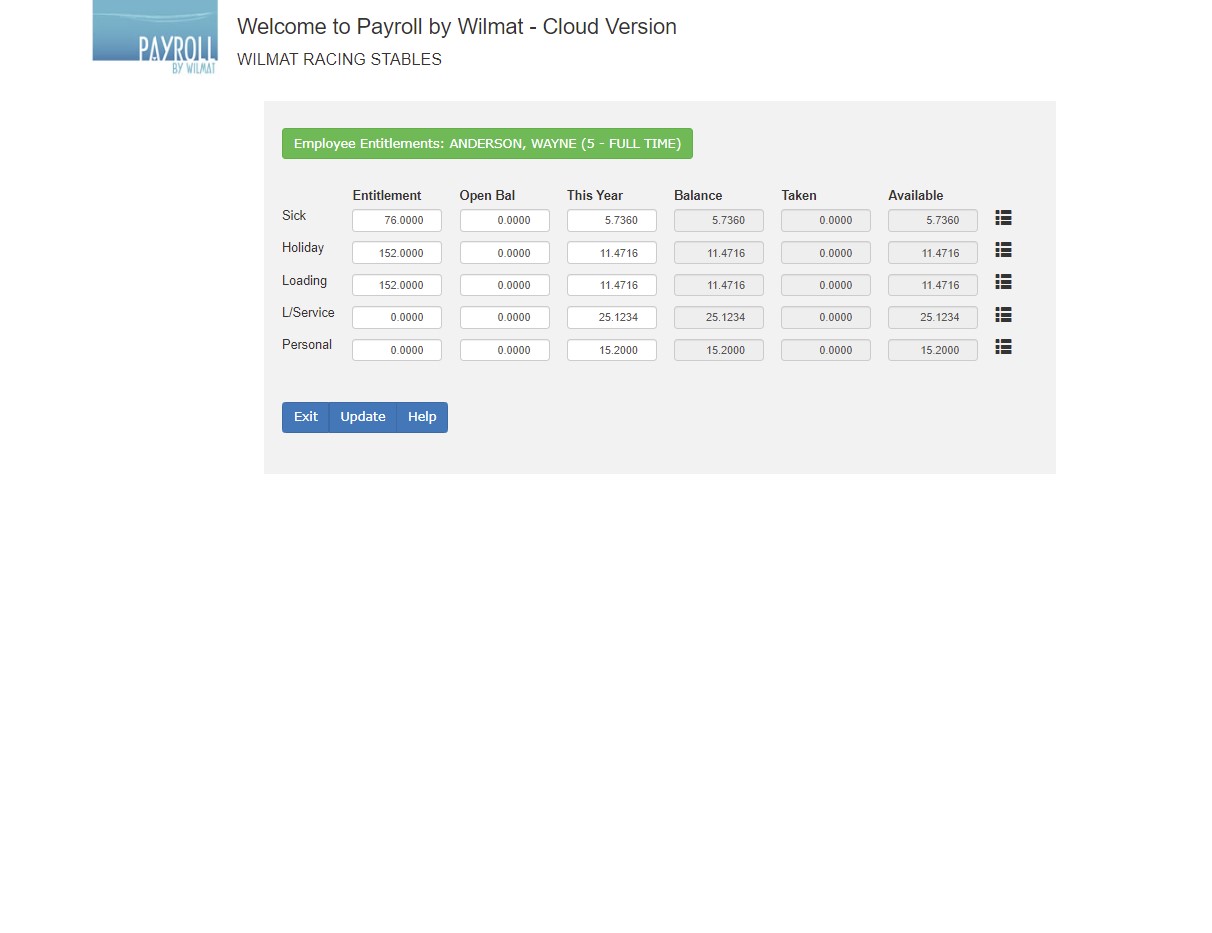

Entitlements

If the employee is entitled to Sick Leave and/ or Holiday Leave and Loading complete the leave entitlement section. As pays are processed by the system the amount of leave will be accumulated. For example, if a weekly employee is entitled to 152 hours (4 weeks) annual leave, the system will accumulate 1/52 (or 2.9231 hours) of annual leave each pay period. Leave taken during the course of the year will be recorded and deducted for the employee's leave entitlements.

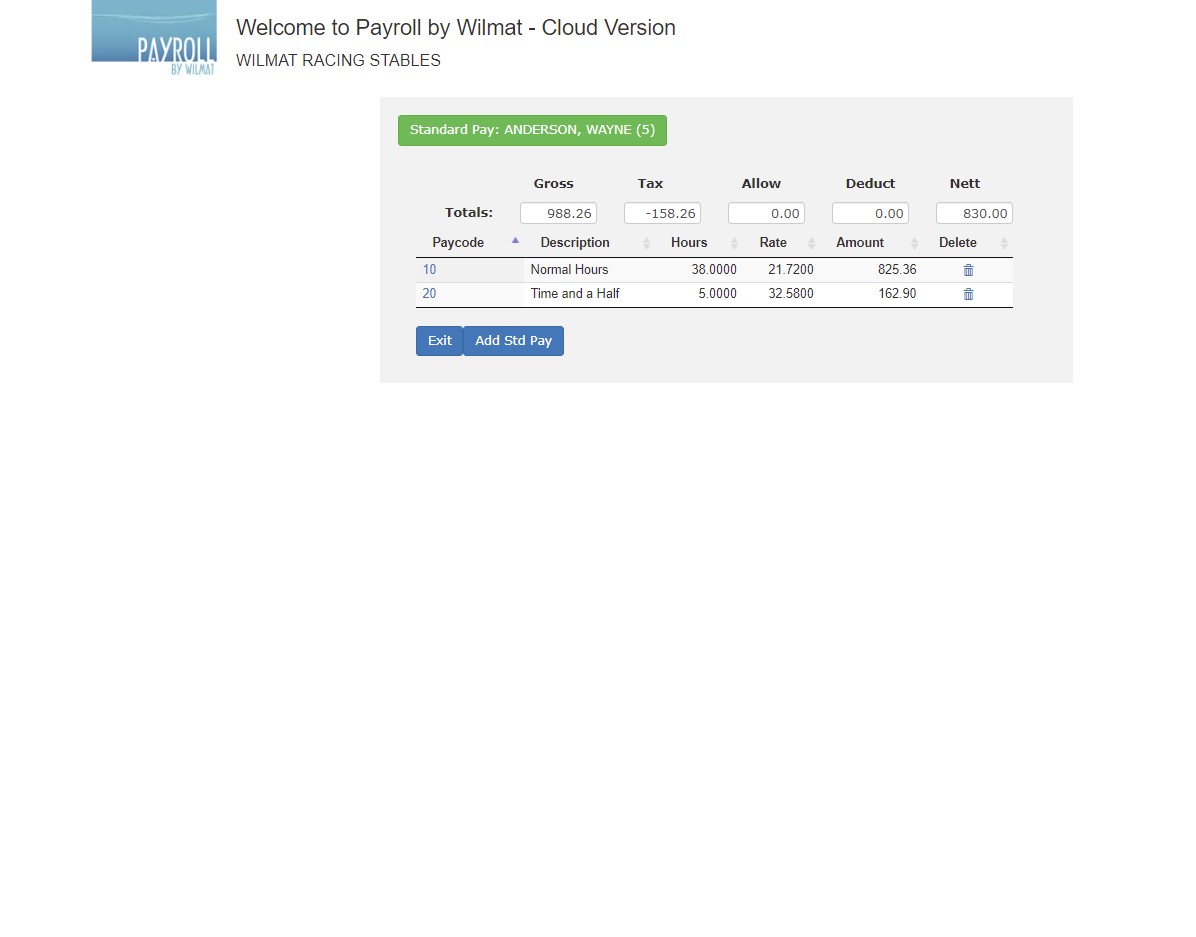

Standard Pay

Within Payroll you can define a standard pay for each employee. When the system commences a new pay period the standard pay for each employee is copied to the current pay transaction file. The pay is adjusted for any variations that have occurred in the current pay period. Setting up a standard pay will save considerable time in the weekly pay processing cycle.

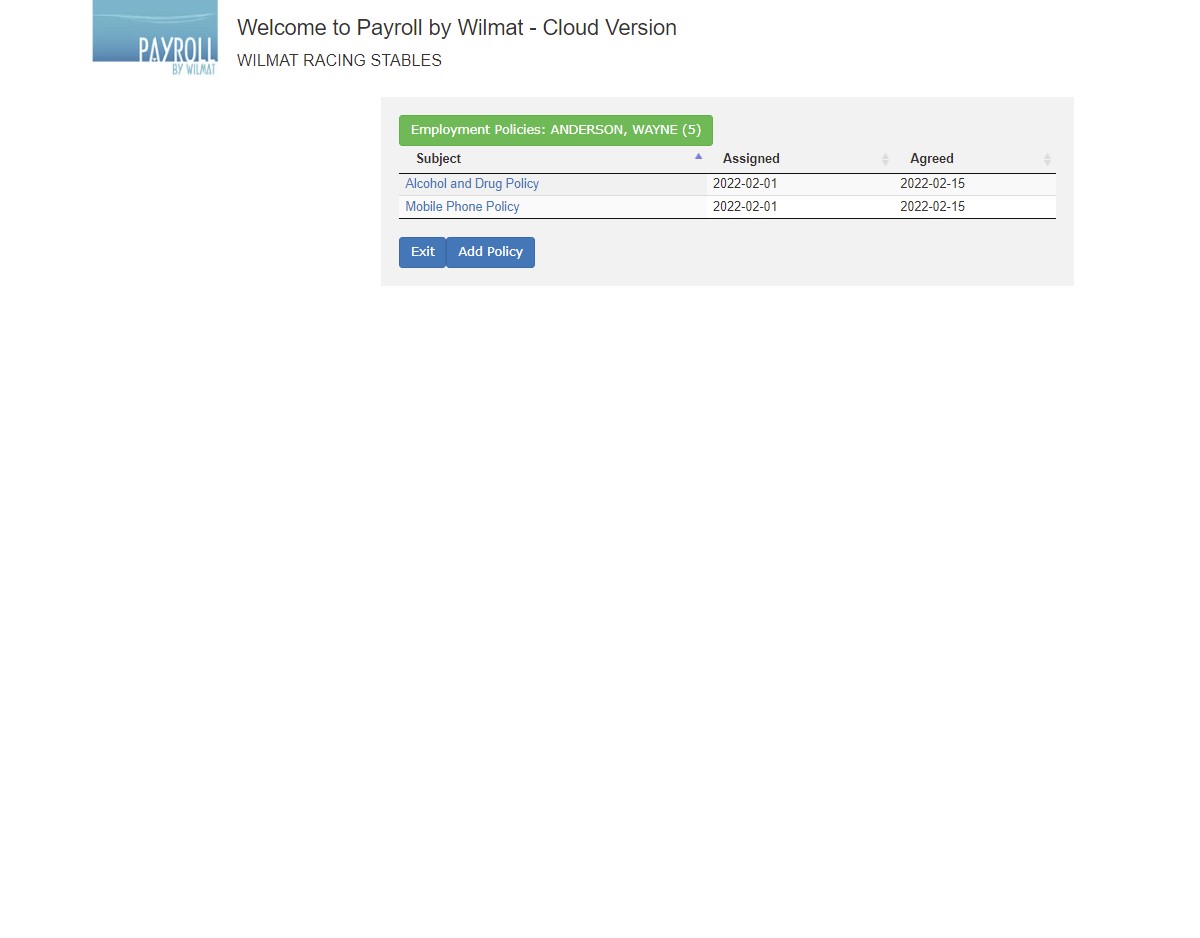

Policies

Clear, up-to-date and robust employment policies inform employees what is and is not appropriate behaviour in your workplace, and help staff to comply with your expectations. Strong employment policies and compliant-management procedures also ensure you can respond with confidence if your staff act inappropiately.

With Payroll you can select which of your company policies appy to each employee. You can record when a particular policy was assigned to an employee and when the employee agreed to abide by the policy. Before an employee commences employment you can send him/her an email which they can use to view and accept each of the policies that apply to them. This procedure also allows the employee to complete a form to provide their name and address and other details required for their employment.

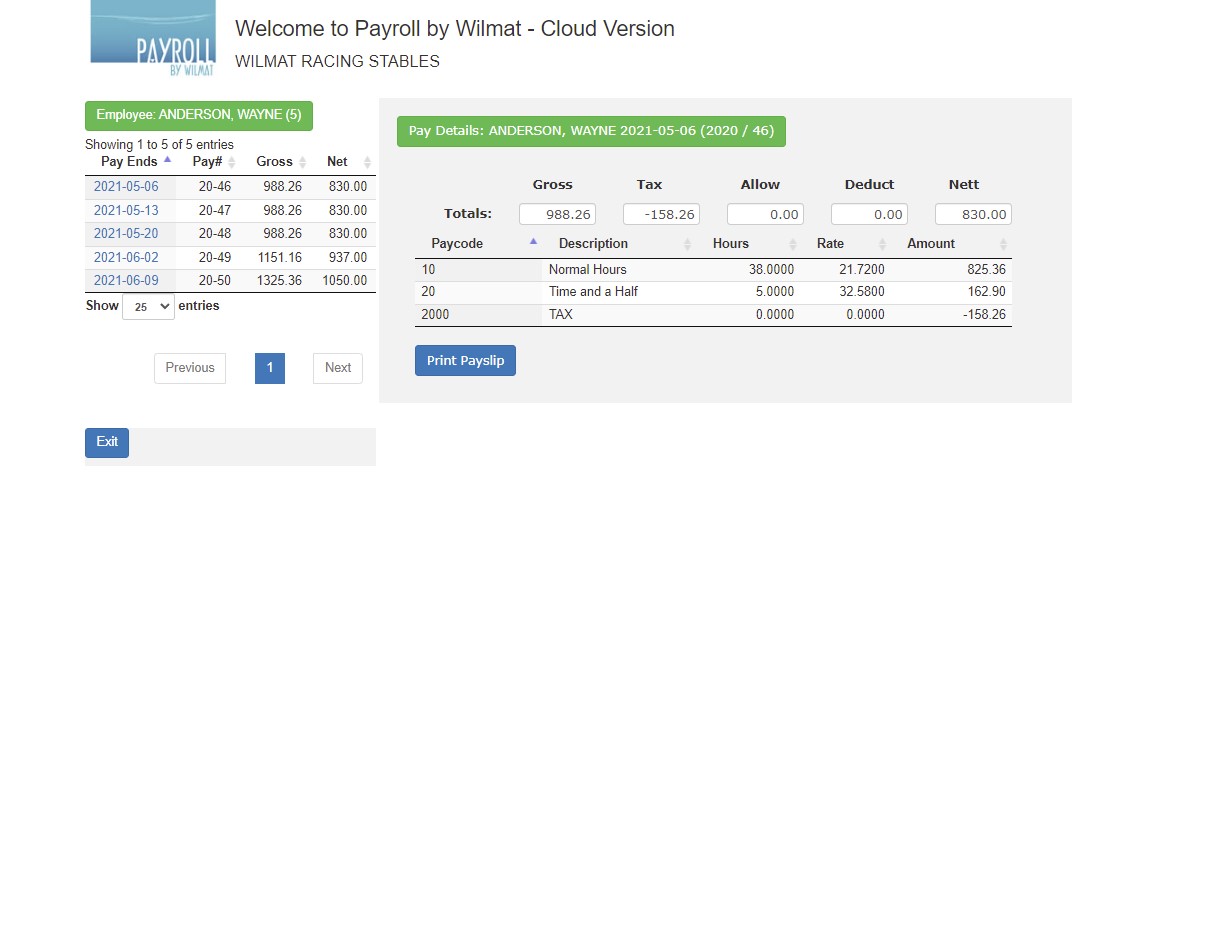

Payroll History

The payroll system keeps details of each pay made by the system. Previous pays for an employee made be viewed and payslips printed for any previous pay period.