Payroll by Wilmat Tour - Pay Entry

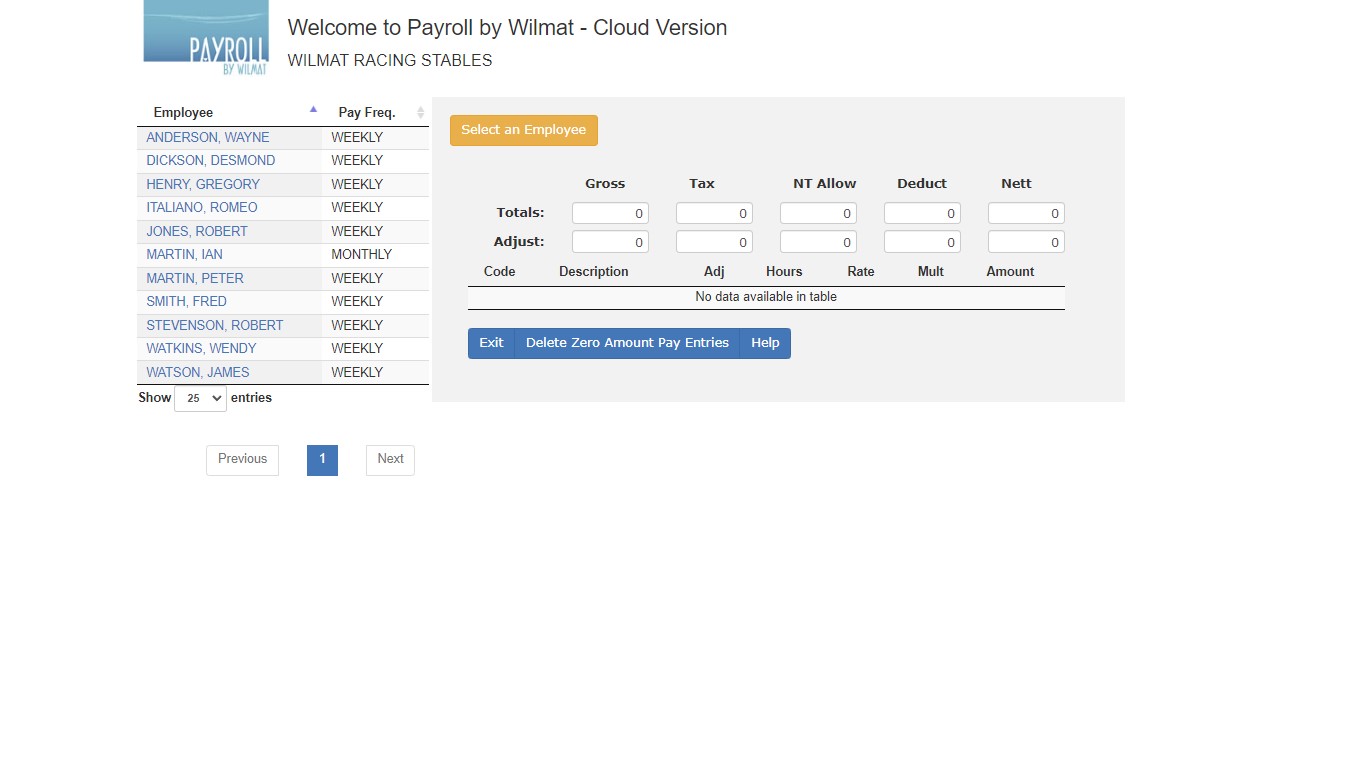

Select the required employee to display the payroll entries for the current pay period.

Select "Delete Zero Amount Pay Entries" to delete current pay period entries that have a pay amount equal to zero.

Tax is automatically re-calculated by the system when you click on an employee. Additional tax can be deducted from an employee's pay by using the Tax Adjustment pay code.

- create a new payroll transaction.

- delete the transactions for the current employee and copy the standard pay entries.

- display the payroll history for the current employee.

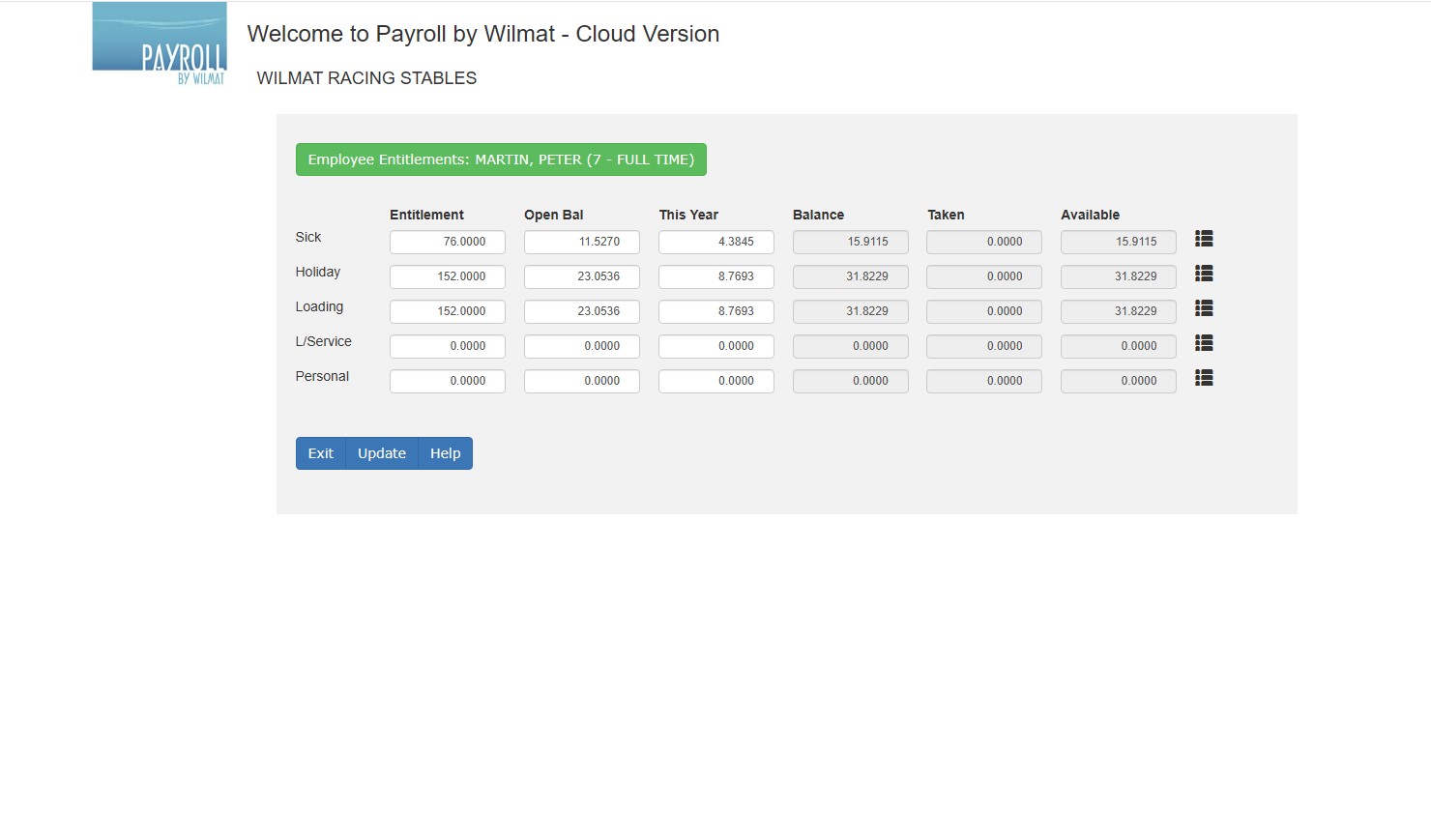

- display the entitlements for the current employee.

- enter the hours from the employee's time card.

Pay Entry - New Pay Transaction Entry

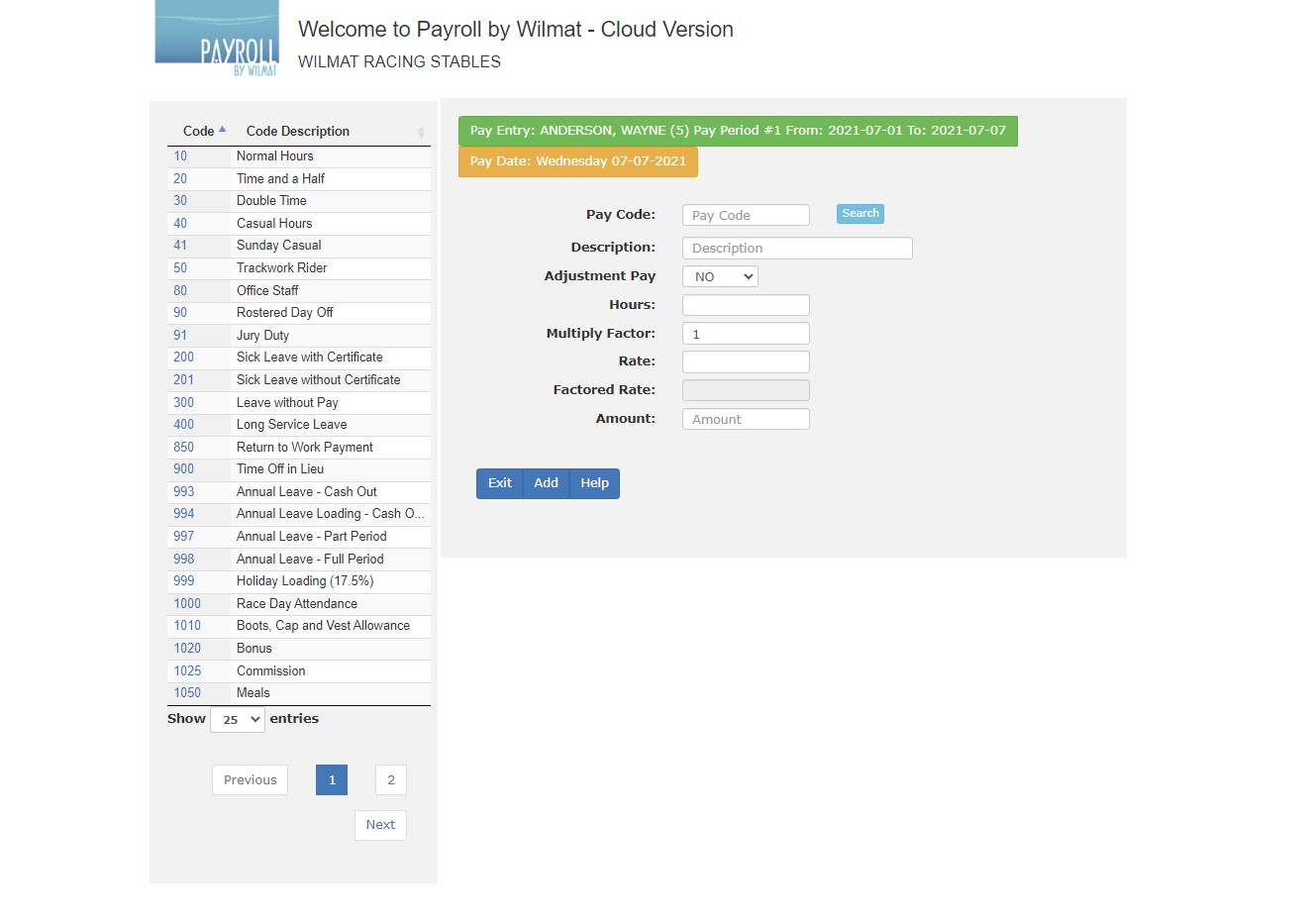

Select the required Pay Code from the list of pay codes on the left of the screen or click the search button to display a popup list of pay codes.When you select a pay code the default hours, multiply factor and rate are displayed. The hours will display from the employee's regular hours. The multiply factor will display from the pay code file and the rate will display from the employee rate or if no rate for the employee has been entered the rate will display from the pay code.

The Factored Rate is the rate times the multiply factor. The amount is the hours times the factored rate.

For non adjustment entries, the rate must be negative for Deductions and positive for Non Taxable Allowances. For adjustment entries the rate can be negative or positive to enable adjustments to previous entries.

For Deduction and Non Taxable Allowance paycode the hours will revert to 0 and the multiple factor will revert to 1. The factored rate and amount will revert to the rate. In other words, the amount for these entries is not calculated it will be equal to the rate value.

- exit without saving the new payroll transaction.

- save the new payroll transaction.

Back

Pay Entry - Changing an Existing Pay Transaction

From the list of pay transactions, clicking on the pay code will allow you to change the selected entry. The tax entry, pay code 2000, is calculated by the system and cannot be changed manually. Use the Tax Adjustment pay code to vary the amount of tax calculated.

The pay code cannot be changed for an existing entry. You must delete and re-create an entry with the required pay code.

- exit without saving changes to the existing payroll transaction.

- save the changes to the payroll transaction.

- delete the current entry. You will be prompted to confirm the deletion. Press Delete again to delete the entry.

Back

Pay Entry - Payroll History

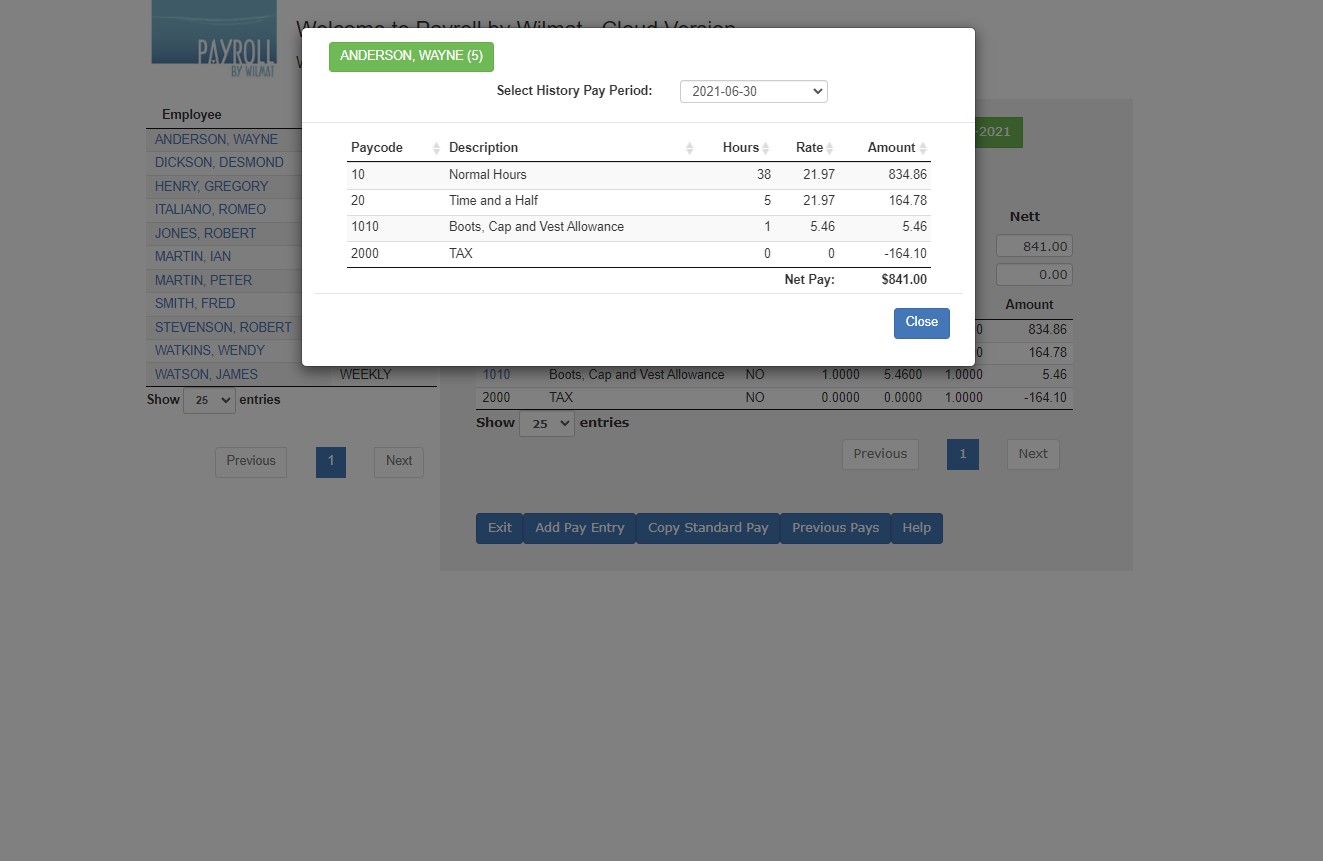

When you click the Previous Pays button a pop up screen will be display showing the pay transactions for the previous week.

Use the drop down window to select the pay transactions for other previous pay periods.

- exit the display of previous pays.

Back

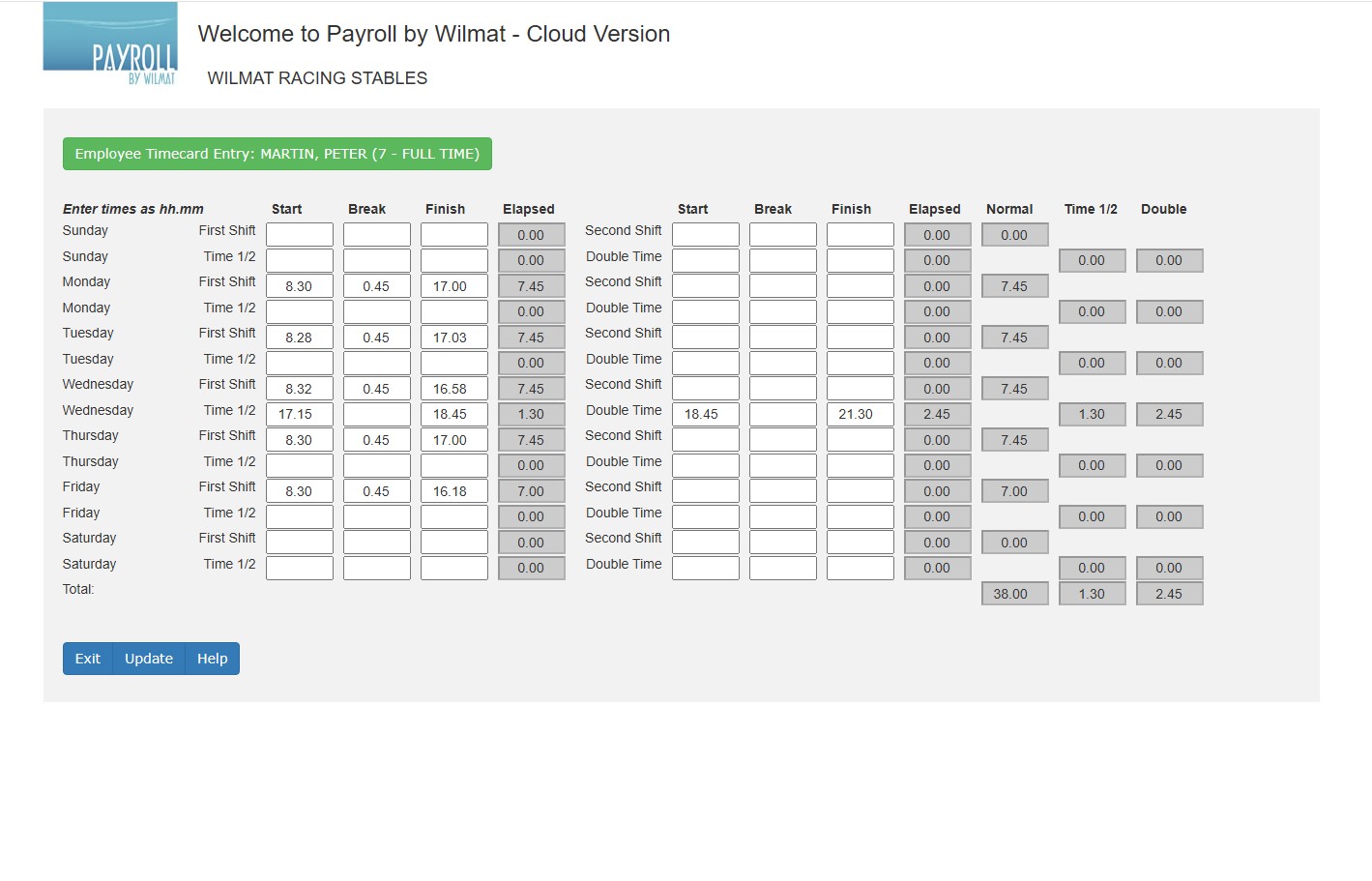

Pay Entry - Time Card Entry

The Time Card Entry facility allows you to enter the Start, Finish and Break times for the employee from a timeclock clock card. You can enter up to two shifts per day and hours for time and a half and double time payments.

The columns on the right display the daily totals for normal, time and a half and double time hours. Totals at the foot of the page show weekly/fortnightly totals for the employee.

Times are entered and displayed in hh.mm format. When all the times from the clockcard have been entered select "Update" to convert the totals into payroll transactions. The minute values will be converted to decimal values ie. two hours thirty minutes will display as 2.30 and will be converted to 2.50 hours in the payroll transaction.

Times entered can optionally rounded up or down to the nearest 15 minutes. This setting to turn on this rounding can be found in the Settings / Options menu option.

Back