Payroll by Wilmat Tour - Termination Pay Entry

Termination pays are entered via the Pay Entry program. The calculation of the tax on the termination pay requires that the Regular Hours and Pay Rate fields have been entered correctly foe the employee. If these values have not been entered the termination tax will not calculate correctly.

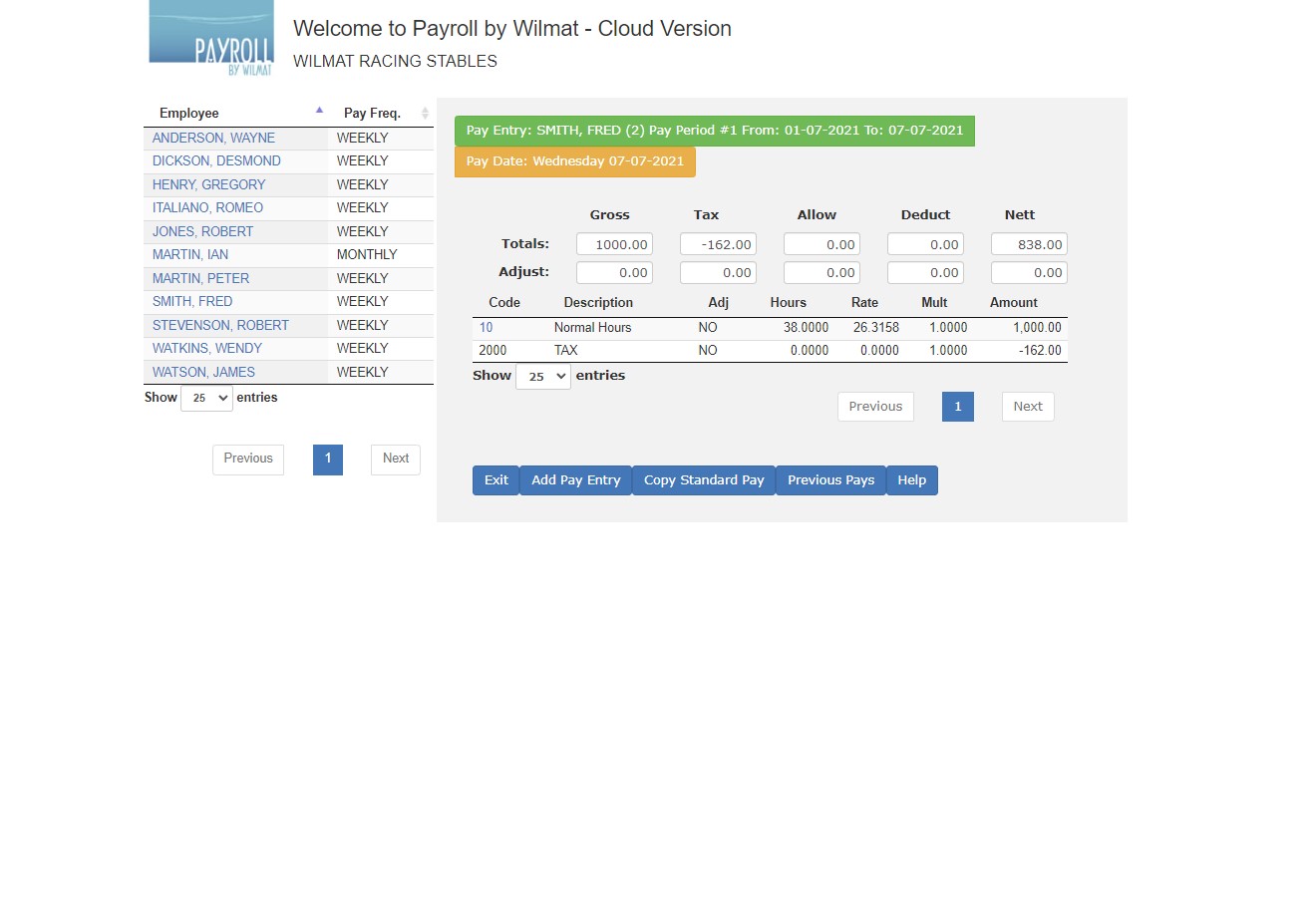

Select the required employee from the employee list on the left hand side of the screen. The program will display existing entries for the selected employee. If the existing entries are not required they can be deleted

Select Add Pay entry to commence entry of the termination pay.

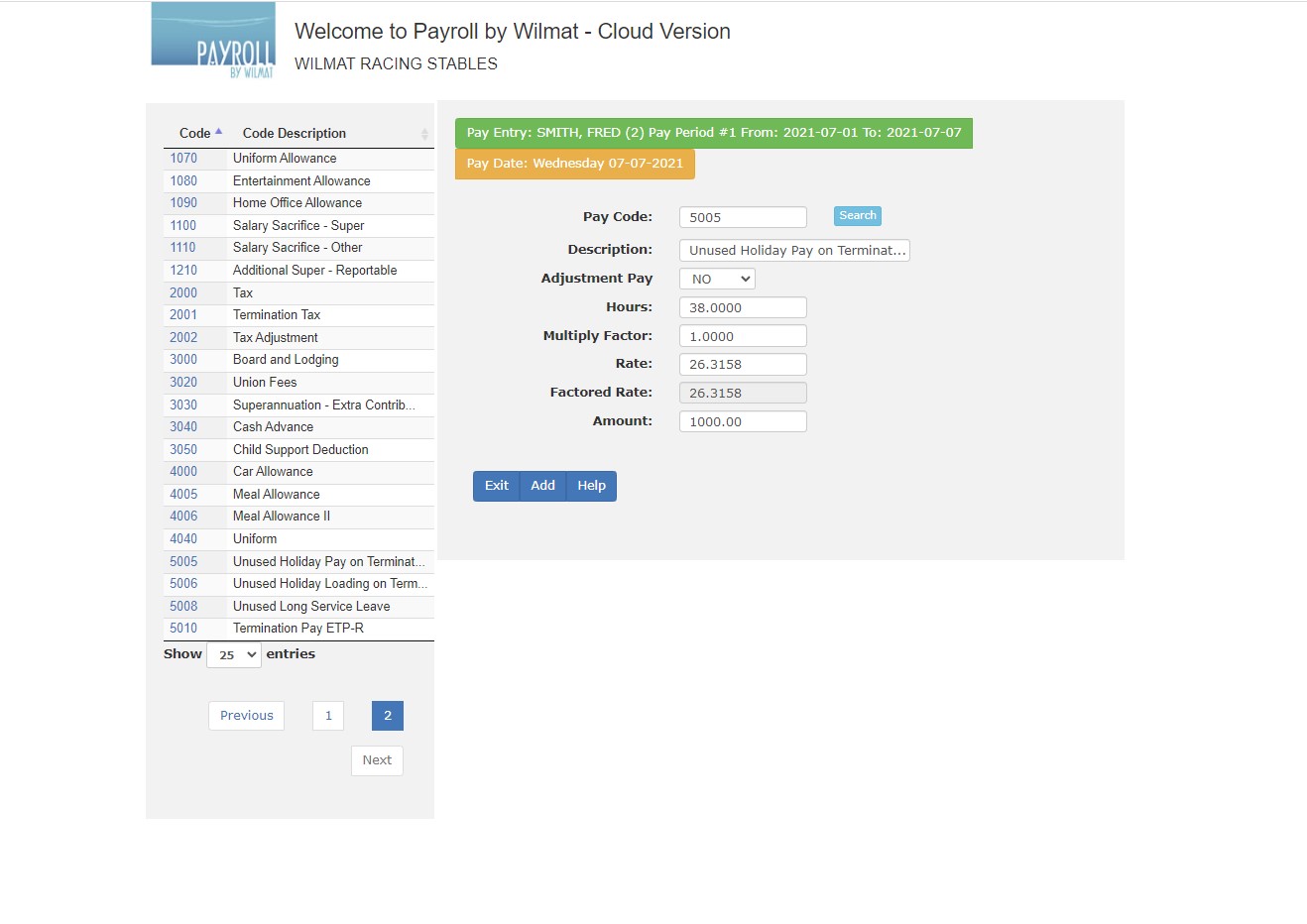

The pay codes used for the termination pay must be in the 5000 range. This enables the special processing and tax calculations to be used. The termination pay will generally consist of unused annual leave and unused annual leave loading. The annual leave loading should have a multiply factor of 0.1750 this equates to the leave loading rate of 17.5%.

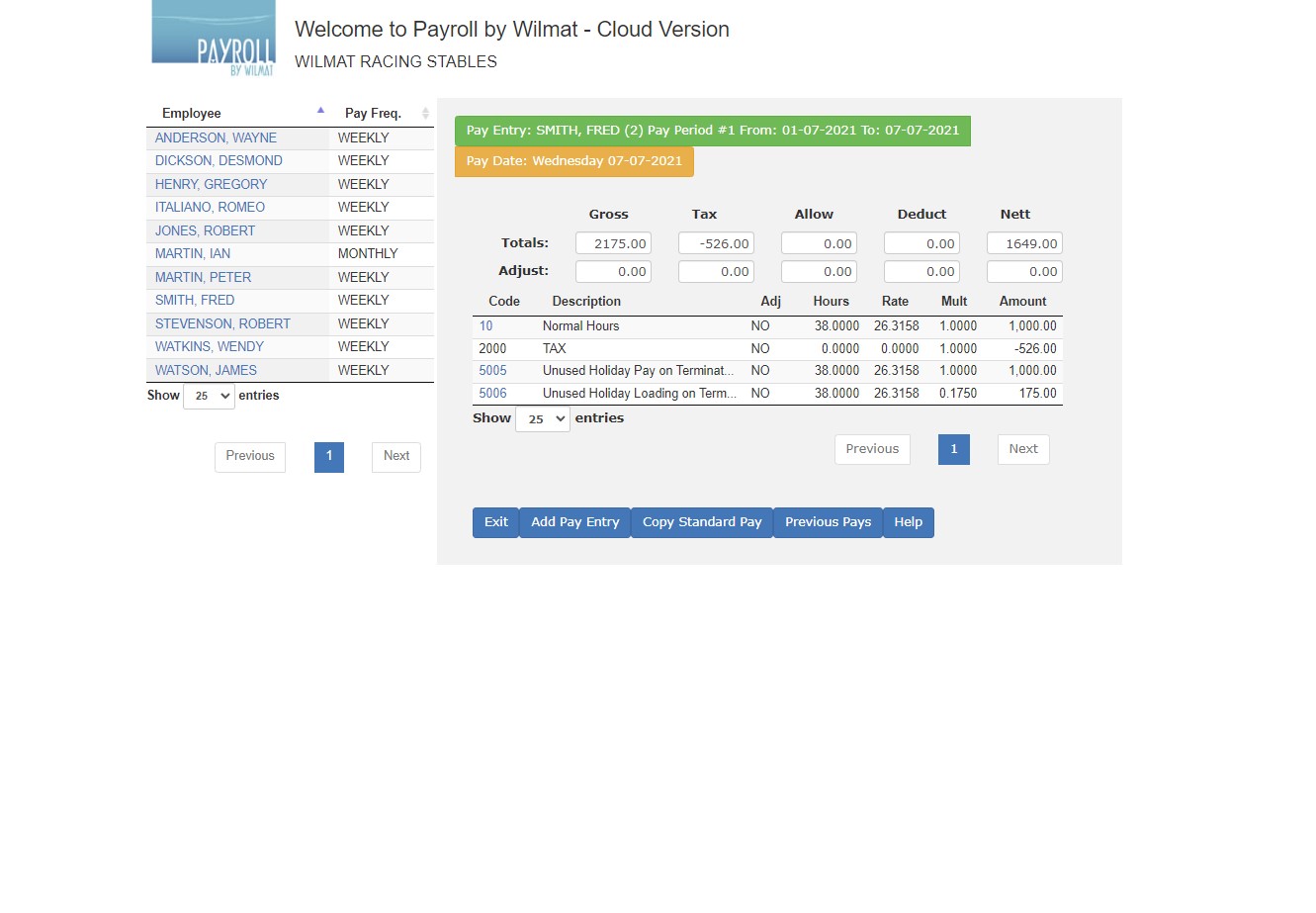

Your entries should look something the screen above.

In this example, the employee's usual tax on his 38 hour week is $162.00 and his total tax is now $526.00, which means that the tax payable on his termination pay has been calculated at $364.00

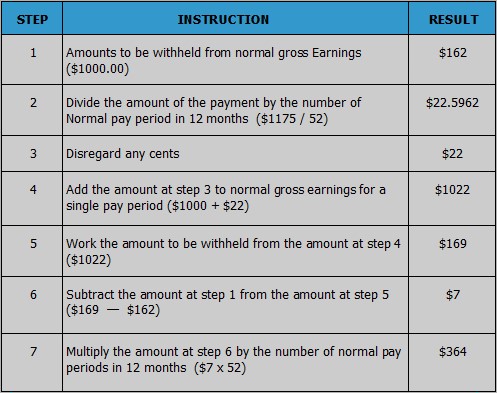

The tax on Termination Pay is calculated at the employee's "Marginal Rate" as shown in the following table.